Exemptions from the prescription charge

Published on: 18th June 2013 | Updated on: 19th April 2023

QUICK LINKS |

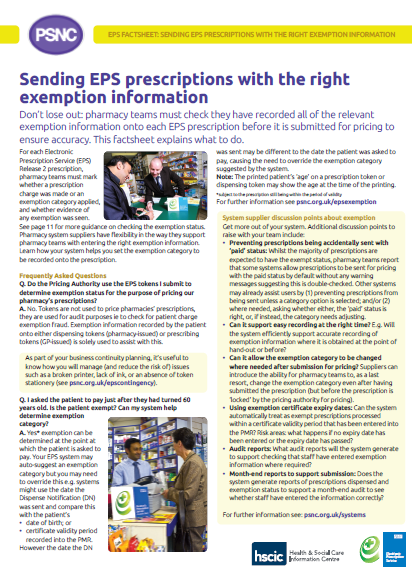

| REF: Drug Tariff Part XVI |

| Switching |

| HRT Prescription Prepayment Certificates (PPCs) |

| Prescription Charge Refunds |

In February 2023, the Department of Health and Social Care (DHSC) announced that patients in England will be able to access cheaper Hormone Replacement Therapy (HRT) for menopause through a new HRT prescription prepayment certificate (HRT PPC). From 1 April 2023, patients who are not already exempt from NHS prescription charges will be able to purchase an annual HRT PPC for the cost of two single prescription charges. The Department of Health and Social Care (DHSC) has issued guidance on the HRT PPC at https://www.nhsbsa.nhs.uk/hrt-ppc-guidance.

The HRT PPC can be used against any listed HRT medicine licensed for the treatment of menopause. The HRT PPC will be available to purchase through the NHS Business Services Authority (NHSBSA) website or from selected pharmacies.

For more information on the new prescription forms see our Community Pharmacy England Briefing 008/23: FAQs to support DHSC guidance on the new HRT PPC (updated 5 April 2023)

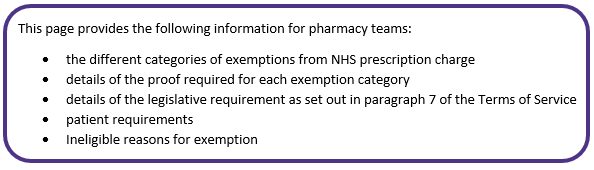

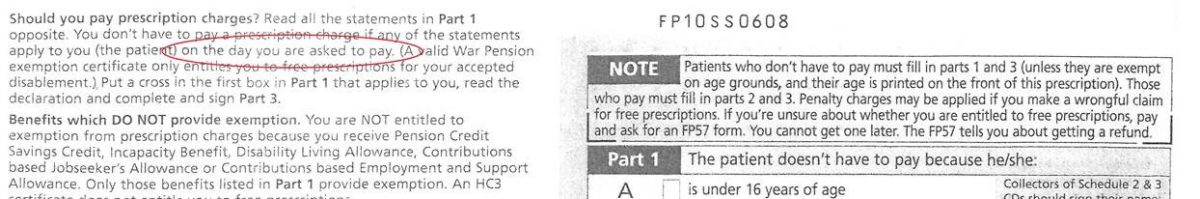

A patient’s exemption status applies at the time of dispensing. Any time a patient makes a declaration that they are exempt from paying an NHS prescription charge, pharmacy staff must ask them to sign a declaration and produce evidence. Pharmacies must advise the person claiming exemption from prescription charges, where evidence is required but not provided, that the NHS undertakes checks to verify that such persons are eligible for free prescriptions. This is a legislative requirement of terms of service The National Health Service (Pharmaceutical and Local Pharmaceutical Services) Regulations 2013 under paragraph 7.

| Current prescription charge exemption category (form v.1219) (EPS code) |

Who is exempt? | Proof required | How to apply for exemption | Previous prescription charge exemption category (form v.0515) |

| A. is 60 years of age or over or is under 16 years of age EPS code 0002 |

Patients of 60 years of age or over and patients of 16 years of age or under. |

Birth certificate, passport or medical card. Please note: Patients over 60 years or under 16 years with a printed date of birth on the prescription do not need to provide any proof of age or make a declaration on the reverse of the form. |

N/A | Age exemption was split into 2 separate categories A. is under 16 years of age C. is 60 years of age or over |

| B. is 16, 17 or 18 and in full time education EPS code 0003 |

Patients aged 16, 17 or 18 and in full-time education from an establishment such as a school, college, or university or similar, including home tutoring. Please note: Apprenticeships are not eligible. (However, patients may qualify for a HC2 certificate under the NHS Low Income Scheme |

Proof of age can be found on a child benefit award letter, birth certificate, passport or medical card and proof they are a full-time student can be obtained from the patient’s school, college, university or local education authority (LEA). | N/A | No change |

| D. Maternity exemption certificate EPS code 0005  |

Expectant mothers or those who have given birth in the previous 12 months are exempt from NHS prescription charge if they are in possession of a valid Maternity Exemption (MATEX) certificate. Patients who have had a miscarriage, abortion/termination of pregnancy or stillborn birth can continue to claim free NHS prescriptions using their MATEX certificate until it expires. |

Possession of a valid Maternity Exemption (MATEX) certificate. Pharmacies may be presented with one of the following types of MATEX certificates:

More information can be found on the NHS Help with Health Costs website. NHSBSA has an exemption checking service to allow individuals to check if they hold a MATEX certificate and confirm if it is still valid to use. Please note: Patients who are pregnant or have given birth in the last 12 months without a valid maternity exemption certificate are NOT entitled to free NHS prescriptions

|

Midwives, practice nurses or health visitors can register online with NHSBSA to issue MATEX certificates on behalf of new or expectant mothers. Once approved, using a smartphone or tablet device, mothers can present their digital MATEX certificate sent to their registered email address, or bring a printed hard copy of their certificate to the pharmacy. For more information on MATEX certificates patients can speak to NHS Help with Heath Costs: 0300 330 1341

|

No change |

| E. Medical exemption certificate EPS code 0006  |

Patients with certain medical condition/s or physical disability as listed in Part XVI of the Drug Tariff and are in possession of a valid medical exemption certificate. |

Possession of a valid medical exemption certificate. NHSBSA has an exemption checking service to allow individuals to check if they hold a medical exemption certificate and confirm if it is still valid to use. Please note: Patients with one or more qualifying conditions without a valid medical exemption certificate are NOT entitled to free prescriptions. |

Patients must complete an FP92A form available from GPs. The GP will then send the form to NHS Help with Health Costs who will issue a certificate. For more information on medical exemption certificates patients can speak to NHS Help with Heath Costs: 0300 330 1341 |

No change |

| F. Prescription prepayment Certificate (PPC) EPS code 0007  |

Patients in possession of a valid PPC at the point of dispensing. Please note: A PPC is valid for either 3 months or 12 months, depending on the type of PPC purchased. |

Possession of a valid PPC. Pharmacies may be presented with one of the following types of PPCs.

Click here for more information on PPCs. NHSBSA has an exemption checking service to allow individuals to check if they hold a PPC and confirm if it is still valid to use. |

Patients can purchase a digital PPC

By contacting PPC helpline on 0300 330 1341 |

No change |

|

W. HRT only prescription prepayment certificate EPS code: 0020 |

Patients in possession of a valid HRT PPC at the point of dispensing. Please note: An HRT PPC is valid for 12 months. |

Possession of a valid HRT PPC. Pharmacies may be presented with one of the following types of PPCs.

Click here for more information on HRT PPCs. |

Patients can purchase a digital HRT PPC

By contacting PPC helpline on 0300 330 2089 |

Previously not listed |

| G. Prescription exemption certificate issued by Ministry of Defence EPS code 0008 |

Patients holding a War Pensioner exemption certificate and possess an NHS prescription for items prescribed for their accepted disablement. |

Possession of a War Pension exemption certificate. Please note: Prescribers are requested to split items between forms into those items prescribed for their accepted disablement and those that are not; this is necessary so that only those items for the accepted disablement are provided without a prescription charge.

|

For an up to date War Pension certificate, war pensioners can contact Veterans UK helpline: 0808 1914 218, or write to: Veterans UK |

Previously listed as G. Has a valid War Pension Exemption certificate |

| L. HC2 (full help) certificate EPS code 0009  |

Patients who have applied for full help with health costs through the NHS Low Income Scheme and are in possession of a valid HC2 certificate. Please note: A partner named on a HC2 certificate and any dependent children (under 19 years of age and in full-time education) who normally live in the same household as the person with a valid HC2 certificate will also be entitled to free prescriptions while the certificate is valid. Names of any dependents are not printed on the HC2 certificate, therefore the holder of certificate may need to provide evidence of a dependent’s entitlement to help with health costs, such as a Child Benefit or Child Tax Credit letter. |

Possession of a valid HC2 certificate. The NHSBSA has an exemption checking service to allow individuals to check if they hold a HC2 certificate and confirm if it is still valid to use. Please note: Possession of a HC3 certificate (partial help with health costs) does not provide any help towards the costs of NHS prescriptions.

|

Patients must complete the HC1 form, available from pharmacies, Jobcentres, GP practices and Citizens Advice. Patients can also download and print the HC1 forms from NHS Help with Health Costs website or can order the forms by contacting the NHS Low Income Scheme helpline: 0300 330 1343 Pharmacies can obtain HC1 forms from PCSE via their online portal. NHSBSA are trialling a new online NHS Low Income Scheme application process for patients who do not have capital/savings of over £6,000 and who must be either: a pensioner |

No change |

|

H. Income Support (IS) or Income-related Employment and Support Allowance (ESA) |

Patients who get or are included in an award of someone receiving Income Support. This includes partners (including civil partners) or any dependents under the age of 20 Patients who get or are included in an award of someone receiving Income-related Employment Support Allowance (ESA). This includes partners (including civil partners) or dependents under the age of 20 of patients in receipt of Income-related ESA. |

Possession of an Income Support award notice or letter.

Possession of an Income Related Employment and Support Allowance award notice or letter. Please note: Possession of contribution-based ESA, paid on its own, does not provide any help towards the costs of NHS prescriptions.

|

Patients can check online if they are eligible for Income Support and apply by contacting the Jobcentre Plus helpline: 0800 169 0350

Patients can download and complete application form for Income-related ESA or make a claim by contacting the Jobcentre Plus helpline: 0800 169 0350 |

No change |

| K. Income-based Jobseeker’s Allowance (JSA) EPS code 0012 |

Patients in receipt of income-based JSA or those included in an award for JSA – this could be the partner of or any dependent under 20. |

Possession of a JSA award notice Please note: Possession of contribution-based JSA, paid on its own, does provide any help towards the costs of NHS prescriptions. |

Patients can check online if they are eligible for Income-based JSA and apply by contacting the Jobcentre Plus helpline: 0800 055 6688 | No change |

| M. Tax Credit exemption certificate EPS code 0013  |

Patients (including any partners and any dependent children included in their tax credit claim) with an annual family income used to calculate Tax Credits of £15,276 or less and receive either:

will automatically be sent an NHS Tax Credit exemption certificate by NHSBSA. |

Possession of a valid NHS Tax Credit exemption certificate (presented as a double-sided A4 paper certificate) or Tax Credits award notice. Certificates are valid for up to 7 months and if a patient is still entitled, he/she will be sent a new certificate before their current one expires. The NHSBSA has an exemption checking service to allow individuals to check if they hold a Tax Credit exemption certificate and confirm if it is still valid to use. Please note: if a patient receives Working Tax Credit on its own, or has an income over £15,276, he/she would not automatically qualify for any help towards the costs of NHS prescriptions. |

There is no need for patients to apply for this exemption. If eligibility conditions are met, HM Revenue and Customs will inform NHSBSA who will automatically issue NHS Tax Credit exemption certificates to eligible patients. For more information on NHS Tax Credit exemption certificates patients can speak to NHS Help with Heath Costs: 0345 300 3900 | No change |

| S. Pension Credit Guarantee Credit (including partners) EPS code 0014 |

Patients and their partners in receipt of Pension Credit (Guarantee Credit) paid on its own, or Pension Credit (Guarantee Credit with Savings Credit). |

Possession of a Patient Credit Guarantee Credit award letter. Please note: Possession of Pension Credit (Savings Credit), paid on its own, does provide any help towards the costs of NHS prescriptions. |

Patients can apply online or speak to the Pension Credit claim line: 0800 731 0469 |

No change |

| U. Universal Credit and meets the criteria EPS code 0016 |

Patients in receipt of Universal Credit, and in their most recent assessment period have earnings of: • £435 or less • £935 or less if their Universal Credit includes an element for a child, or if the patient has limited capability for work and work-related activity.The ‘most recent assessment period’ runs for a calendar month from the date of the Universal Credit claim. |

Possession of a Universal Credit award notice or statement. Please note: Being in receipt of, or named on an award of, Universal Credit does not automatically entitle patients to help with their health costs. Entitlement to free prescriptions is dependent on the patient’s earnings for the most recent assessment period. For couples, the earning limit applies to the joint income of the patient and their partner. |

Patients can check if they are eligible and apply online for Universal Credit or contact the Universal Credit helpline: 0800 328 5644 |

Patient previously selected K. Income-based Jobseeker’s Allowance (JSA). Please note: Patients should tick the box K for ‘income-based JSA’ on the patient declaration on this version of the form and on EPS |

| Current free-of charge item category on the NHS (form v.1219) |

Who is exempt? | Proof required | How to apply for exemption | Previous free-of-charge item category on the NHS (form v.0515) |

| Was prescribed free-of-charge contraceptives EPS code 0010 |

Patients in possession of an NHS prescription for drugs and/or appliances used for contraceptive purposes as listed in Part XVI and Part IXA of the Drug Tariff, respectively.

For drugs not listed in the Part XVI of the Drug Tariff (for example Dianette), prescribers must endorse the item with the ‘CC’, ‘OC’ or the female symbol ‘♀’ to indicate if the item is for contraceptive purposes to ensure that it is treated as a free-of-charge item by NHSBSA |

N/A | N/A | Previously listed as category ‘X’ for “was prescribed free-of-charge contraceptives”. This category has been removed from the reverse of the new FP10 form and Tokens (1219). Patients are not required to sign the prescription form or make a declaration of entitlement to receive these free-of-charge (FOC) items. This category was removed because the NHSBSA automatically identify the FOC contraceptives listed in the Drug Tariff and those marked for contraceptive purposes accordingly, to ensure no prescription charges are deducted regardless of paid/exempt status declared by the patient.Note: The EPS message code ‘X’ (0010) for ‘was prescribed free-of-charge contraceptives’ will remain on EPS systems that usually display it. This message code remains on EPS systems because population of a message code field is mandatory before an EPS claim is submitted for payment to the NHSBSA. |

| Was prescribed free-of-charge sexual health medication EPS code 0017 |

Patients in possession of an NHS prescription for an items endorsed ‘FS’ for the free supply. | N/A | N/A | N/A |

| Current exemption category (form v.1219) |

Who is exempt? | Proof required | How to apply for exemption | Previous Exemption category (form v.0515) |

| Prisoners on Release EPS code 0015 |

Prisoners who are released from prison unexpectedly can get their medicines for free against HM prison-issued FP10 or FP10MDA prescriptions until they arrange to see their GP or register with a new GP. | Possession of a valid FP10 or FP10MDA prescription with the following information printed in the box provided for the practice address on the front of the form:

If the information above is included on the prescription the patient is classed as automatically exempt and does not need to complete the declaration on the reverse of the form. |

N/A | N/A |

A new Hormone Replacement Therapy Prescription Prepayment Certificate (HRT PPC) has been introduced. In February 2023, the Department of Health and Social Care (DHSC) announced that patients in England will be able to access cheaper Hormone Replacement Therapy (HRT) for menopause through a new HRT prescription prepayment certificate (HRT PPC). From 1 April 2023, patients who are not already exempt from NHS prescription charges will be able to purchase an annual HRT PPC for the cost of two single prescription charges. The Department of Health and Social Care (DHSC) has issued guidance on the HRT PPC at https://www.nhsbsa.nhs.uk/hrt-ppc-guidance.

The Government has decided that the cost of an HRT PPC will be equivalent to two single prescription charges in England. From 1 April 2023, a single prescription charge is £9.65 per item and an HRT PPC will cost £19.30. An HRT PPC is valid for 12 months from the start date and covers an unlimited number of listed HRT medicines.

The HRT PPC can be used against any listed HRT medicine licensed for the treatment of menopause. The HRT PPC will be available to purchase through the NHS Business Services Authority (NHSBSA) website or from selected pharmacies.

The list of HRT medicines covered by the HRT PPC will be published in Part XVI of the NHS Drug Tariff from April 2023. The up-to-date HRT medicines list will also be available on the HRT PPC application page and the NHSBSA help with health costs page.

Click here to view Community Pharmacy England Briefing 008/23: FAQs to support DHSC guidance on the new HRT PPC (updated 5 April 2023).

Click here to view Community Pharmacy England HRT Prescription Prepayment Certificates (PPCs) webpage.

A new prescriber endorsement FS for ‘free supply of sexual health treatment’ has been introduced. This enables prescribers to endorse prescriptions for STIs to indicate to dispensers that the patient should not be charged. The FS endorsement should not be manually added to the EPS dosage instructions field as this would not allow a pharmacy to supply any treatment for STIs free-of-charge against NHS prescriptions.

Click here to view Dispensing Factsheet: New prescriber endorsement ‘FS’ for free supply of sexual health treatment

Click here to view Community Pharmacy England’s briefing on the changes to the reverse of the prescription form which contains detailed information on FS.

Part XVI, Clause 10 of the Drug Tariff sets out the arrangements for charging of contraceptives.

Prescriptions for the following items are automatically exempt from prescription charges:

- spermicidal gels, creams, films and aerosols

- systemic contraceptive preparations listed in Part XVI

- contraceptive devices listed in Part IXA of the Drug Tariff.

However, there are some products, such as Co-cyprindiol 2000mcg/35mcg tablets, which whilst they do not appear in Part XVI, are sometimes used for contraceptive purposes. In this scenario, if the doctor has endorsed the prescription with “CC”, “OC” or the female symbol (♀) to make it clear that the item is for contraceptive use, the patient should not incur a prescription charge.

On 1 July 2016, pharmacy contractors will be required by their Terms of Service, before supplying the drug or appliance, to advise the person claiming exemption from payment of NHS prescription charges – where evidence is required but not provided – that NHS checks are routinely undertaken to verify that such persons are exempt from payment of NHS prescription charges, as part of arrangements for preventing or detecting fraud or error. It is up to pharmacy teams how this is done but it must be in “appropriate terms”. The legislative requirement is set out in paragraph 7 of the Terms of Service, which is available to view here.

Where appropriate, pharmacy staff should advise patients of the required certificates and how they might go about obtaining them (e.g. Medical Exemption Certificates required for patients suffering from diabetes, epilepsy etc. as well as exemption certificates on maternity grounds, low income, or Prescription Prepayment Certificates (PPC)).

If a valid certificate of exemption has been shown, for example a medical exemption certificate or pre-payment certificate, and noted on the PMR along with the certificate’s expiry date, it is not necessary to ask the patient to show proof again within the validity of that certificate. Patients claiming exemption because they receive Income Support or Jobseeker’s Allowance (income-based) should be asked to provide their evidence of entitlement on each occasion.

Where patients do not have evidence or where there is doubt over whether the evidence provided is appropriate, the “Evidence not Seen” box on the back of the prescription should be marked with an X by pharmacy staff. Pharmacy staff need not refuse to dispense items on the basis that the patient does not provide evidence of their entitlement to free prescriptions.

Patients are not required to make a signed declaration if:

- they are age exempt (and the patient’s age is computer printed on the front of the script);

- all items present on the prescription are ‘free-of-charge’;

- the prescription is for ‘Prisoners on Release’; or

- the prescription has been confirmed as exempt by the Real Time Exemption Checking (RTEC) system

Community Pharmacy England Briefing 032/16: NHS fraud checking notification (June 2016) includes our tips of key things to consider to make compliance with this new requirement a matter of routine.

Pharmacy contractors are in no way responsible for the accuracy of a patient’s declaration; this remains the responsibility of the patient. NHS Protect have a responsibility to check for prescription charge exemption fraud and patients found to have wrongly claimed for free prescriptions, could face a penalty charge and in some cases prosecution. This applies even where the patient has a medical condition which qualifies for exemption, if the patient does not have a valid exemption certificate on the date the patient is asked to pay or complete the exemption declaration.

If a patient is unsure whether they are entitled to free prescriptions, pharmacy staff should advise the patient to pay for their prescription and provide them with an FP57 Refund form with information on how to claim a refund at a later date. Further information for patients can be found at www.nhs.uk/healthcosts.

Those in receipt of the following benefits are not eligible to claim for exemption from prescription charges in England:

- Contribution-based Jobseeker’s Allowance and Employment and Support Allowance paid on its own;

- Pension Credit (Savings Credit), paid on its own;

- HC3 certificate for limited help with health costs;

- Any benefit paid on its own and not listed on the back of a prescription (such as Disability Living Allowance, Personal Independence Payment or Incapacity benefit); and

- Asylum seekers – if supported by the National Asylum Support Service (NASS), NASS will automatically send a NHS Low Income Scheme HC2 certificate entitling them to help with health costs including free prescriptions. Patients can apply for support using the HC1 application form if needed.

For a full list of benefits that do not entitle patients to exemption from the prescription charge see Prescription Services website here.

In addition to the current endorsing information, pharmacy staff will also have to mark whether a prescription charge was levied for a prescription, and where relevant the prescription charge exemption category and whether evidence of exemption was seen. The exception to this is where the patient is age exempt and the patient’s date of birth is included in the electronic prescription message.

Pharmacy system suppliers have flexibility in the way they support pharmacists in entering this information, for instance if pharmacy staff have already recorded the details of a valid exemption certificate, e.g. a pre-payment certificate, the system could be set to pre-populate this information on the system – the pharmacy would still be required to collect the patients exemption declaration on the prescription or dispensing token where required.

See more at our EPS exemption page or in the factsheet below:

Information required about… |

Who to contact |

| FP57 forms | See page Where to obtain external resources |

| NHS Low Income Scheme | NHS Help with Health Costs: 0300 330 1343 or 0191 279 0565 |

| Prescription pre-payment certificates (PPC) | NHSBSA: 0300 330 1341 or 0191 279 0563 |

| Hormone Replacement Therapy Prescription pre-payment certificates (HRT PPC) | NHSBSA: 0300 330 2089 |

| Medical and Maternity exemption certificates | NHSBSA: 0300 330 1341 or 0191 279 0563 |

| NHS Tax Exemption Certificate | NHS Help with Health Costs: 0300 330 1347 or 0191 279 0567 |

| HC1 (low income scheme) details and related forms | See page Where to obtain external resources |

| Prescription Exemption Checking Service | NHS Prescription Exemption Checking Service: 0300 330 9291 |

You can also visit the Help with Health Costs website here.

Q. Are young people aged 16, 17 or 18 on apprenticeships automatically exempt from prescription charges?

No. Whilst there is an exemption for those who are 16, 17 or 18 in full-time education, NHS Help with Health Costs have confirmed that apprenticeships do not qualify for free prescriptions. Full-time education means you must be receiving full-time instruction from a recognised educational establishment, such as a school, college or university.

However patients aged 16, 17 and 18 undertaking an apprenticeship who are on a low income are able to apply for help with their health costs using the HC1 form. If they are successful with their application, they will receive an HC2 certificate which would entitle the patient to receive free prescriptions.

More information on Help with Healthcare costs is available here.

Q. I have a prescription for a patient who was 59 when his prescription was written: however, the patient did not handover the prescription to be dispensed until they were 60. Is the patient age exempt from paying a prescription charge?

Yes, subject to the prescription still being within the period of validity. The reverse of a prescription says that entitlement to prescription exemption is based on the patient’s circumstances on the day they are asked to pay. In this case, as the patient was over 60 when they entered the pharmacy to have their prescription dispensed, they would therefore be age exempt from paying a prescription charge.

For paper prescriptions, where the patient’s age is shown on the front of the prescription as “59” they would not be age exempt, unless their 60th birthday has taken place between the time of being provided with the prescription and making their declaration of exemption. The patient should sign the back of the prescription form to declare that they are indeed over the age of 60 on the day they are asked to pay.

For EPS prescriptions, your EPS system may auto-suggest an exemption category but you may need to override this, e.g. systems might use the date the Dispense Notification (DN) was sent and compare this with the patient’s:

- date of birth; or

- certificate validity period recorded into the PMR.

However, the date the DN was sent may be different to the date the patient was asked to pay, causing the need to override the exemption category suggested by the system. Please note: The printed patient’s ‘age’ on a prescription token or dispensing token may show the age at the time of the printing.

You can check the paid/exemption category currently applied onto an electronic prescription using your PMR system.

For further information on EPS exemptions, see cpe.org.uk/epsexemption

Q. A person has presented a prescription and made a declaration that they are exempt from paying a prescription charge. I have asked them to produce satisfactory evidence of such entitlement, but they do not have it with them. Do I need to do anything else apart from ticking the “evidence not seen” box on the prescription?

Yes. From 1st July 2016, the Terms of Service are amended to require pharmacy contractors, before supplying the drug or appliance, to advise the person who has been asked to provide the evidence of entitlement to exemption that NHS checks are routinely undertaken to verify that persons are exempt from payment of NHS prescription charges as part of the relevant arrangements for preventing or detecting fraud or error.

Q. How can I use my PMR system to check and amend EPS Release 2 exemptions to avoid switches and payment issues?

You can check the paid/exemption category currently applied onto an electronic prescription using your PMR system.

PMR systems should assist users by (1) preventing prescriptions being sent to the Pricing Authority unless an exemption category option has been selected; and/or (2) where needed, asking whether either, the ‘paid’ status is right, or, if instead, the category needs adjusting.

EPS prescriptions should also be able to have their exemption status amended at any time after claim notification has been sent, and the EPS prescription has been sent to the Pricing Authority, as long as the prescription’s relevant ‘5th of the month’ pricing deadline has not passed (see EPS five day window logic). NHS Digital has made amendments to the Spine to allow this functionality to be implemented and one PMR system already has this functionality available to users according to NHS Digital information.

For further information on EPS exemptions, see cpe.org.uk/epsexemption

Q. Are migrants automatically exempt for NHS prescription charges?

A. No, to be exempt from prescriptions charges they would need to be in possession of a valid HC2 (full help) certificate. The route of obtaining the HC2 (full help) certificate may depend on whether the migrant is classed under refugee or asylum seeker status.

Asylum seekers: Patients should apply for support using the HC1 form.

Refugees: if supported by UK Visa’s and Immigration (UKV&I), NHSBSA will automatically send a HC2 (full help) certificate entitling refugees to help with health costs including free prescriptions. If they are not supported by UKV&I they would need to complete an and state they are not supported.

If a patient is unsure whether they are entitled to free prescriptions, pharmacy staff should advise the patient to pay for their prescription and provide them with an FP57 Refund form with information on how to claim a refund at a later date. Further information for patients can be found at www.nhs.uk/healthcosts.

Q. Am I required to ask patients for evidence of their HRT PPC if they declare exemption from paying prescription charges for HRT medicines for this reason?

A. Any time a patient makes a declaration that they are exempt from paying an NHS prescription charge, pharmacy staff must ask them to sign a declaration and produce evidence. Pharmacies must advise the person claiming exemption from prescription charges, where evidence is required but not provided, that the NHS undertakes checks to verify that such persons are eligible for free prescriptions. This is a legislative requirement of terms of service The National Health Service (Pharmaceutical and Local Pharmaceutical Services) Regulations 2013 under paragraph 7.

Q. Is a patient that has had a miscarriage exempt for NHS prescription charges?

A. A patient with a valid Maternity Exemption Certificate (MATEX) who has a miscarriage, abortion/termination of pregnancy or stillborn birth is entitled to free prescriptions until their certificate expires. This is because patients may still require on-going medical treatment that requires medication to be prescribed on a FP10 prescription.

A patient who has given birth (including to a child registered as stillborn) within the last 12 months, can still apply for a certificate. However, patients who have miscarried but not yet applied for a MATEX are not be entitled to apply for a certificate.

Q. Do patients need make a declaration on prescriptions for contraceptives?

A. On new version of FP10 form (v. 1219)

Box X “was prescribed free-of-charge contraceptives” has been removed from the new prescription form (v.1219) and tokens because legislation does not require a patient to make a declaration or sign a form to receive free-of-charge (FOC) prescription items listed in the Drug Tariff (Part IXA Contraceptive Devices and Section 10 Part XVI ‘List of Contraceptive Drugs to be Dispensed Free of Charge’) or for items that are annotated ‘CC’. Ideally, prescribers should not include items classed as FOC on the same prescription form as a chargeable item. If, however, a prescription contains other items for which a charge should normally be levied, the prescription should be processed as either charge paid, or where appropriate, the relevant exemption category should be selected.

On older versions of FP10 form (v.0515)

Patients no longer need to mark box X “was prescribed free-of-charge contraceptives” and sign Part 2 of the prescription. Ideally, prescribers should not include items classed as FOC on the same prescription form as a chargeable item. If, however, a prescription contains other items for which a charge should normally be levied, the prescription should be processed as either charge paid, or where appropriate, the relevant exemption category should be selected (Box ‘X’ should not be ticked if a patient is exempt from charges for other reasons for example has a valid medical exemption certificate).EPS

Whilst category X is to be removed from the reverse of the new FP10 forms and Tokens, the EPS message code ‘X’ (0010) for “was prescribed free-of-charge contraceptives” will remain on EPS systems that usually display it. This message code remains on EPS systems because population of a message code field is mandatory before an EPS claim is submitted for payment to the NHSBSA.

Ideally, prescribers should not include items classed as FOC on the same prescription form as a chargeable item. If an EPS prescription includes a FOC contraceptive and another chargeable item, and the prescription is submitted with the “was prescribed free-of-charge contraceptives” category code ‘X’ (0010), a charge deduction will apply to the chargeable item even if the patient was exempt from prescription charges for other reasons, for e.g. has a valid medical exemption certificate. An EPS prescription of this type should be submitted with actual exemption reason which is applied at a form level rather than the item-level reason, “was prescribed free-of charge contraceptives”, for entitlement to free prescriptions.

Q. How do NHSBSA process NHS prescriptions for free-of-charge contraceptive?

A. The Drug Tariff (Part IXA and Part XVI) lists FOC contraceptive items which do not require a prescriber endorsement. Items prescribed for contraceptive purposes but not listed in the Drug Tariff need to be annotated by the prescriber with initials ‘CC’ or the female symbol (♀) so that a charge is not levied for any items so marked. The NHSBSA automatically identify the FOC contraceptives listed in the Drug Tariff and those marked for contraceptive purposes accordingly, to ensure no prescription charges are deducted regardless of paid/exempt status declared by the patient.

Q. Do I need to request proof of a patient’s exemption status before I can dispense their prescription?

A. Pharmacy staff should ask to see evidence of patients’ entitlement to free prescriptions and check the expiry date on any certificates presented. Pharmacy staff need not refuse to dispense items on the basis that the patient does not provide evidence of their entitlement to free prescriptions. If t proof of exemption cannot be provided, patient should be asked to sign and declare their stated reason for exemption and the pharmacy should mark the ‘Evidence Not Seen’ box on the form with a ‘X’.. Pharmacy contractors are required by their Terms of Service, before supplying the drug or appliance, to advise the patient claiming exemption from payment of NHS prescription charges – where evidence is required but not provided -that NHS checks are routinely undertaken to verify their entitlement to free prescriptions, as part of arrangements for preventing or detecting fraud or error. Patients can be signposted to NHSBSA’s eligibility checker to find out if they are entitled to free NHS prescriptions or use the NHSBSA’s exemption checking service to check if they hold a valid exemption certificate. to check if they hold a valid exemption certificate.

If a patient is unsure as to whether they are entitled to free prescriptions or is waiting to find out if they are eligible, he/sheshould be advised to pay the prescription charge(s) and ask the pharmacy for a FP57 refund form. Patients can apply for a refund (within three months) if they can later confirm their eligibility for free prescriptions and are able to provide proof of exemption. Patients who claim free NHS prescriptions that they are not entitled to may face a penalty charge of up to £100.

Q. Are patients who receive incapacity benefits exempt from paying prescription charges?

A. No. A patient claiming incapacity benefits would not be exempt from paying a prescription charge. They would need to meet the other exemption criteria to be entitled to free prescriptions. Click here to view the eligible exemptions. Other ineligible reasons from prescription exemption charge include:

- Disability Living Allowance

- Personal Independence Payment

- Attendance Allowance

- Council Tax Benefit

- Housing Benefit

- New Enterprise Allowance

- Carer’s Allowance

Related resources

Dispensing Factsheet: Exemptions from the prescription charge

Dispensing Factsheet: New prescriber endorsement ‘FS’ for free supply of sexual health treatment

Prescription Charge Card and Multi Charge Card

Is this prescription form valid?

Controlled Drug prescription forms and validity

How to identify prescriber codes

Number of items – getting your declaration right

Prescription form section of the Pricing Authority’s website (external)